Full and Final Settlement (FnF): The Definitive Guide in 2024

What is The Full and Final Settlement?

FnF Settlement is also known as the Full and Final Settlement. It is a process of calculating different payable dues to an employee who is resigning, retired, or terminated, from an organization. In this FnF policy, an employee has to be paid for the last working month and tax deductions & bonus earnings. This procedure of recovering and paying during resignation is called Full and final settlement.

What are the Rules for FnF Settlement?

The new labor law for FnF payments states that the company must pay the complete salary settlement within two days after the employee has completed their last working day, backing their dismissal, resignation, or termination. However, there isn’t a formulated date for the full and final payment settlement directed in the act. Usually, 30-45 days is ideal to pay the total and absolute compensation.

The HR unit is usually in charge of handling this process. The FnF settlement process usually takes a month to be completed from the date of the employee’s resignation. The full and final settlement is a complex process, which requires extensive knowledge of the subject and experience.

Full and Final Settlement Under the Payments of Wages Act

The current new age code says that a company has to pay the full and final settlement payments to employees within two days after their last working day.

What does the law state? – “if an employee has been – (i) terminated or discharged from service; or (ii) economized or has resigned from the organization, or has been unemployed if the company has been closed, all the salary settlements related to the employee have to be paid within two days if terminated, dismissed, economization, or if the employee has resigned.

How does FnF Settlement Work?

For paying the employees within a specified time frame, there are several rules that the individual State Governments govern. Make sure you are abiding by the state laws in your state. It depends on the company’s decision if they want to provide the settlement before the termination or after. Create a program for salaried employees. It is a contractual obligation where an employee is supposed to let the organization know and give them a notice before quitting the job. This time gives ample time to the company to find a replacement. Additionally, it allows the employer adequate time to negotiate the settlement terms with the worker. Ensure that you are paying the employee during their entire notice period. Then, as an organization, you can choose whether you want your employee to work during the notice period.

The following entitlements must be included in an employee’s final salary

1. All unpaid compensation for hours performed, including bonuses and fines

2. Any earned paid time off

1. Serve the notice period

An employee should provide a notice period before leaving the organization so that an employer can quickly shift the roles and responsibilities to the new employee. Every company has a different notice period. For example, an IT company gives their employees around 2 to 3 months as a notice period, whereas some companies offer one month’s notice period. (mention notice period days)

2. Handover of company assets

Turn in all the company property like mobile phones, laptops, houses, cars, etc., and afterward collect the ‘no dues’ from your HR.

3. If the employee is Terminated

The terminated employee’s salary is calculated from unpaid to extra payments. The FnF payment is provided after one month of termination, but the employee still needs to receive the experience letter.

4. Salary and retirement benefits

After an employee retires, they receive PF and the full and final settlement.

Major Components of The Full and Final Settlement

During the FnF settlement, paying and recovering involves a variety of components. It’s a complex and time-consuming process, wherein all details and arrears have to be kept in mind. Most companies follow these basic steps for the process:

1. The employee submits his/her resignation letter in writing to your company.

2. Your company’s management team accepts the employee’s resignation letter after an overview.

3. The employee also has to submit a no dues certificate from concerned departments and submit that letter to your company’s HR.

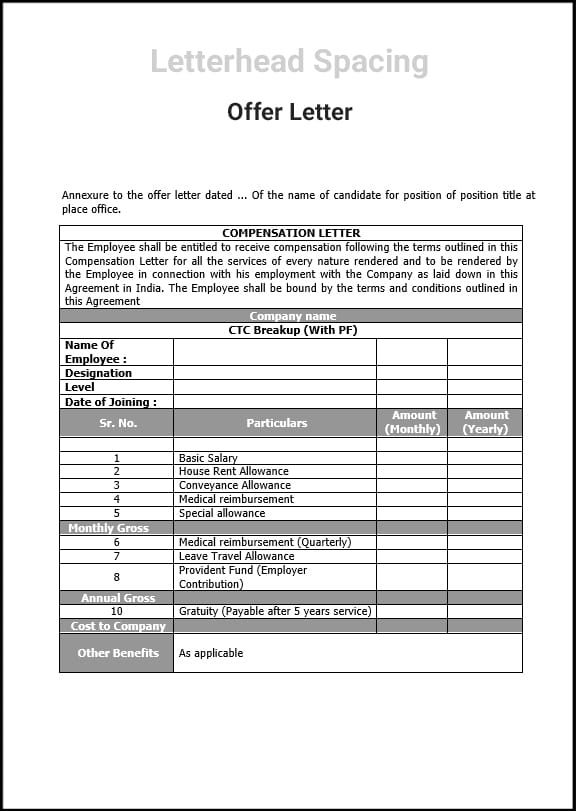

4. In reimbursement, the calculation amount includes gratuity, paid leaves, pensions, etc.

5. The FnF statement is prepared. The accounts department of your organization will then review this statement and clear/reject it. Once the 6 statement is clear by the accounting department, your company’s HR will create the final FnF statement and request a cheque for the balance remaining.

As stated above, the calculation of the final reimbursement amount is the toughest task. We have listed the major components, which result in making the FnF statement. We have also listed out their formulae for calculations. Let’s take a look at all these components in detail.

1. Unpaid Salary

Unpaid salary refers to the total number of days for which an employee has worked, after submitting the resignation. It is usually the time duration between an employee’s resignation date and the last working day. In some cases, unpaid salary may include payments from the past several months (for example, if your employee salary paid quarterly). Unpaid salary also includes any other arrears and LTA (i.e Leave Travel Allowance)

For Calculation of Unpaid Salary:

For Example: (The number of days an employee has worked* gross monthly salary)/ 26 (or the number of paid days in a month)

2. Non-Availed Leaves & Bonus

Your employee’s non-availed paid leaves are also subject to encashment. Any bonuses or special credits offered are also encashed and added to the full and final settlement sum. Regulation has mandated that when an employee resigns, all dues from an employee’s unpaid leaves must be paid on or before the 7th and 10th of the following months. Section 15 (3) of the Karnataka shops & Commercial establishment act also states that ‘All encashment dues must be cleared on or before the 10th of the following month.

For Calculation of Non-Availed Leaves & Bonus:

For Example: (The number of days of unavailing leaves * monthly salary)/ 26 (or the number of paid days in a month). Non-availed leaves will include those who have made an offer as a privilege (usually mentioned in your employee’s contract) and ones that have been earn.

3. Gratuity

Gratuity is a cash benefit that employers provide to their employees, for service to their organization. If an employee has completed a minimum of 4 years or 240 days with your organization, then the gratuity amount has to be paid within 30 days of the employee’s separation from your company. The regulation states that your organization will have to pay gratuity with interest, if not paid within the first 30 days.

For Gratuity Calculation:

For Example: (15 days of last drawn salary for each working year*tenure of working)/26 (or the number of paid days in a month).

4. Deductions

Deductions include an employee’s Income tax, Provident Fund, any Professional taxes (if applicable), and any compensation for the notice period that was not served. Earned leaves that have been cashed, and gratuity is exempted from TDS dues. All other payments will attract TDS( i.e Tax Deducted at Source), according to the Income Tax Act. Segment 72 (5) under the E.P.F Act 1952, mandates that businesses have to forward the E.P.F(Employer’s Provident Fund) guarantee forms within 5 days of the representative presenting the case.

Exact tax deductions will vary according to a variety of factors. Provident fund and professional taxes most often depend upon your employee’s income, agreed-upon in-hand salary, and your organization, among other things.

Income Tax deductions will depend upon your employee’s income bracket. Employers who are earning up to 2.5 LPA are release from Income Taxes in India. An annual income between 2.5-5 LPA is subject to TDS deductions of 5%, and so on.

5. Pension

Employees who have completed a minimum of 10 years of ‘ pensionable service’ with your organization are eligible for pensions. They can avail the pension benefits by providing their ‘Scheme certificate’ after their retirement (or 58 years of age). Most employees get a pension as a part of E.P.S(Employer’s Provident Fund). EPS specifies a minimum pension amount of Rs 1000 and it’s around Rs 7500.

For Calculation of EPS Pension:

For Example: (Pensionable salary*service period)/ 70

An employee’s pensionable salary is around Rs 15,000 and the service period is around 35 years, must be kept in mind.

6. Leave Encashment

After resignation, an employee’s unpaid leave should be clear and all the dues should be done by or before the 7th & 10th of the following month.

Your HR policy will determine the encashment of non-availed leaves. also, these leaves might earn or offer as a privilege. Most organizations use these two ways to encash unpaid leaves.

For Example Per day Basic (Or Basic + DA OR other components)

For Per Day Basic Salary Calculation:

(number of days of non-availed leaves * basic salary) / 26 days ( Avg paid days in a month)

Fixed Amount Defined by The Company

The company may choose to fix an amount which can be encashed against a paid leave, which is not directly dependent on your employee’s salary.

What is Full and Final Settlement in Payroll?

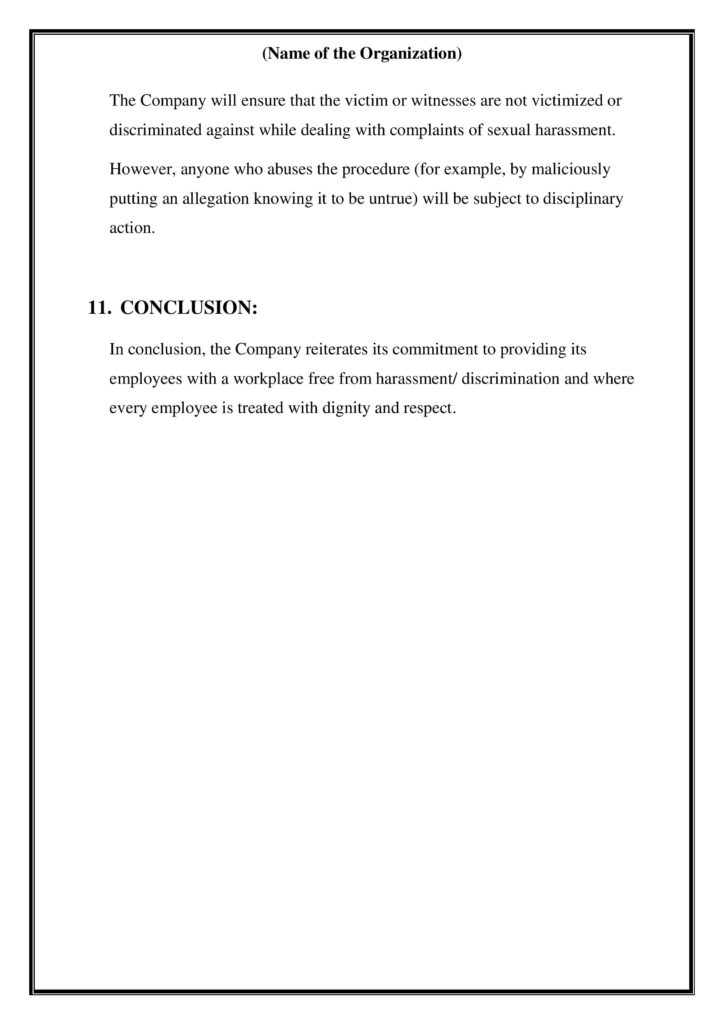

Full and final settlement is a complex, and often confusing process. For leading, money is the core factor with no further complication. Your organization must have a set of clearly defined separation policies, which will make the task easier for your payroll team. We’ve listed out a few policies and strategies which companies often use to simplify their FnF settlement.

1. Clearly Defined Separation Policies

It is important to define your separation policies clearly, both for individual employees and groups. The specified set of rules with regards to the notice period, gratuity, paid/unpaid leave encashment among other things should be there. These policies will help your payroll employees to avoid confusion. This will also reduce disputes in the FnF settlement.

2. Partial Payment in FnF

Some organizations prefer to continue their employee’s payroll process via their regular salary schedule, and withhold their salary for the month-of-exit (i.e their last working month in the organization). This is also called the partial FnF settlement process. You can adopt this strategy as it simplifies calculations. This way the payroll team has to only calculate the TDS and arrears for the last working month.

3. FnF in Bulk, or Individually

For organizations growing at a rapid pace, or organizations may be laying off many employees at the same time, calculating each employee’s payroll separately can become a hectic task. With an increasing volume of FnF settlements, companies opt for a bulk settlement process. Bulk settlements allow companies to process their employee’s arrears in batches, rather than one at a time.

Full and Final Settlement Calculation

The last procedure during employee termination is calculating the termination pay. Again, create a simplified list, so you don’t find yourself in difficult situations.

1. Outstanding wages

If an employee has worked during that period, they should receive the payment for the time they worked with any outstanding award and reward.

2. Payment concerning Notice

Following the Fair Work Act of 2009, companies are permitted to pay an equal sum in lieu of having the employee perform work during the notice period.

You are to pay the total payment to the employee, assuming they have worked during the notice period.

3. Annual Leave

Casual or personal leave taken by the employee is not applicable for encashment. However, annual leaves that are still unused can still be used.

4. Extra Payment

This contains additional salary components as stated by company policy, such as long service leave encashments, contractual rights, redundancy pay, etc.

Conclusion

Full and final settlement is a detailed and organized process. When done properly, it helps a company let systematically go of its employees. The FnF settlement requires expertise in the domain of HR and precise calculations. In today’s day and age, companies make use of custom-made software. The use of software helps them to speed up their FnF process, and avoid any errors in calculations. FnF can also become easy if rules, policies, and frameworks, and clearly defined and stated in an organization. Furthermore, all disputes arising during an FnF process must be handled formally.

Adhering to all the rules and principles of FnF will help an organization avoid unnecessary dues and achieve maximal growth. Companies with good FnF policies often set internal deadlines to achieve the FnF settlement. An ideal full & final settlement process is one wherein the HR department facilitates transactions between all stakeholders and resolves all pending issues before an employee’s last day at work.

Want to make your FnF settlement easier? Check out StartupHR toolkit for the largest collection of HR documents including calculators, policies, letters, and much more! Click here to check it out now.

Join a Community of 1,00,000+ HR Professionals