Top 21 Neobanks in India to Keep an Eye On in 2023

Neobanks in India is a solely digital platform-based fintech firm similar to regular banks. It delivers digital and mobile-first application services like debit cards, lending, money transfers, payments, etc. These financial enterprises provide value-added services, personalized experiences, and data-driven insights to their valuable customer base by leveraging digital platforms.

According to the legit source bfsi. economictimes, it’s anticipated that $394 billion will be raised by Neo banks in the next four years, i.e., by 2026. Almost $90 million were raised by Neo bank India in 2019. It shows how widely the Neo Banks segment in India is scaling up. The Neo banks in India have no branches, physical setups, or bank licenses & operate their functions via virtual networks. It works on a partner bank model & Digibank, Finin, Freo, and Jupiter are some of their examples.

21 List of Neobanks in India

1. Akudo

2. Chqbook

3. Digibank

4. FamPay

5. FI Money

6. Finin

7. Freo

8. InstantPay

9. Jupiter

10. Mahila Money

11. Mool

12. Niyo

13. OneCard

14. Open

15. Paytm Bank

16. Piggy Neobank

17. RazorpayX

18. Uni Card

19. Walrus Club

20. ZikZuk

21. Zolve

List Of Top 21 Neobanks in India in 2023

Here is the thorough List of Neobanks in India:

1. Akudo

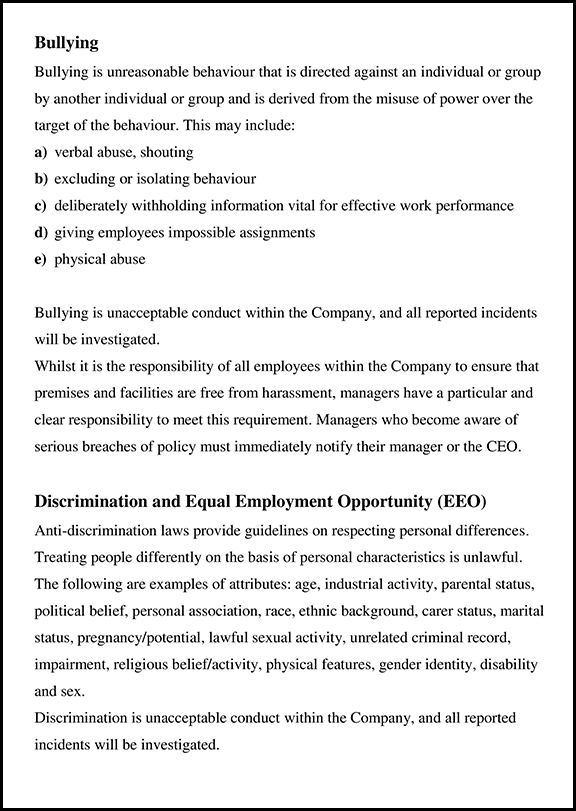

Akudo neobank in India provides a learning focussed banking experience to all teenagers. It means ‘peaceful wealth,’ whose mission is to empower teenagers of India through financial independence & proper knowledge. Everybody between the age group of 11 to 18 is authorize to join this platform. The neo bank has varied features like a reward system, automated savings, personalized VISA debit cards, savings cruise control, bite-sized content for understanding money & rewards for learning.

It believes in providing the prepaid cards deserved by every teen. The bank’s tagline is – ‘a neobank that rewards teens for mastering money.’ The investors of the company are Incubate Fund India and Combinator. The teens can save their money securely, spend wisely and manage freely using the app. Also, teenager can save money under the guidance of their parents.

Website Link: https://www.akudo.in/

Founder: Lavika Aggarwal, Sajal Khanna

Founding Year: 2020

Address: 2nd Floor, 1262/1141, Incubex Building, Sector 7, HSR Layout, Bengaluru, Karnataka 560102

2. Chqbook

Chqbook neo bank is the first-ever neobank in India that caters to small business entrepreneurs. Since September 2020, its Mobile Application has been downloaded by more than 1 million users dwelling in 500+ cities of India. What makes it number 1 is its varied features like 0% fees on loans, reward-based current account opening, daily debit/credit transaction rewards, and customer credit with payment collection tracking features. Chqbook has received several awards during its starting period in India. It has been a winner of Tech30 TechSparks 2019 & Fintech Rocketship 2019. Being your all-in-one financial control center, Chqbook has a customer base of 800,000 individuals.

All the small business owners get tailor-made financial solutions through their varied range of products & services using the substitute data. Neo bank provides top-notch financial services via its five banking roots, i.e., lending, rewards, khata, insurance & banking services. Its most popular range of services comprises Pension Schemes, Home Loans, Investment plans, Saving Schemes, Investment Schemes, Personal Loans Apply, etc. The entire focus of the Chqbook is on bettering the underserved regions so they can benefit from reliable financial help. Almost 30 Billion transaction value yearly is process by this neo bank.

Website Link: https://www.chqbook.com/

Founder: Vipul Sharma

Founding Year: 2017

Address: 401 & 402, 4th Floor, Tower C Magnum Tower II, Golf Course Ext Rd, Sector 58, Gurugram, Haryana 122011

3. Digibank

Digibank is an intuitive, instant, and intelligent Neobanks in India startup with Digital banking services. It offers you varied features like a simplified mutual funds process, up to 4% interest on savings, up to 25,000 INR annual savings, INR 250 Amazon voucher gift card, and Times Prime Lite Membership with Rs 25,000 worth of benefits. Other features include Goal-Based Savings, a Customisable Dashboard, exclusive debit card offers, AI-powered, Intuitive Reminders, easy personal loans, and zero-cost same-day international money transfers. This best neo bank India has a tagline, “The Unbank You Can Bank On!” The motive behind finding this bank by DBS bank in 2019 is to provide a supporting hand to all the customers. This support enables them to perform all their banking services on the online platform.

It authorizes you to keep all of your money completely safe and secure. All the banking customers also get a single collaborative platform for reducing disputes or further unseen problems. You must keep an average Rs 10,000/- balance to be eligible for all such benefits. It is India’s finest and safest neo bank. You get varied vouchers, membership plans, and offers by opening your savings account in Digibank. Paying your monthly bills via digibank is very convenient and straightforward. You get exciting rewards and cashback up to INR 300 once you complete the transaction from their platform.

Website Link: https://www.dbs.com/digibank/in/default.page

CEO: Surojit Shome

Founding Year:1994

Address: DBS Bank India Limited, 1st Floor, Express Towers, Nariman Point, Mumbai – 400021.

4. FamPay

The platform of FamPay neobank in India targets the teenage generation by providing them with a numberless prepaid card. It currently has five million+ registered members who are availing of online transaction services without opening a bank account. Its whole motive is to empower the financial needs of the youth demographic & provide them with financial freedom. Their perks include earning FamCoins with every spend, using FamCoins for cashbacks, offers, discounts on various brands, giveaways, and contest participation.

FamPay has partnered with the IDFC First Bank. Customers can only avail of prepaid cards from this neobank platform. All the prepaid cards are numberless & their issue process is conducted through VISA. Customers get numerous benefits from using numberless features. One of the significant advantages is that teens can smoothly spend money through their prepaid cards hassle-free. They don’t have to stress the extra safety of their guardians’ or parents’ accounts. Everything is carried out with full authorization and by taking online safety measures. Parents can quickly transfer the amount to their children below 18 through cards, UPI, and p2p payments using the FamPay platform.

Website Link: https://fampay.in/

Founder: Sambhav Jain and Kush Taneja

Founding Year: 2019

Address: No.7, 1st A Main, Sector 6, H.S.R Layout, Bengaluru (Bangalore) Urban, Karnataka, 560102

5. FI Money

FI is the RBI-approved money management neobank in India app for salaried millennials or working professionals. It has varied features like zero balance savings account, no hidden fees, zero minimum balance required, INR 5 lakh insured money, commission-free mutual funds, zero forex markup, earn rewards for saving & can be withdrawn from every ATM. FI Money has partnered with Federal Bank. Also, the annual interest rate offered by the neo bank on the savings account is 5.1%. Users are charge 1% of their savings account’s interest rate if they opt for premature withdrawal.

The best part is that all its customers are allowed to open various savings accounts intended for accomplishing their unique purposes. All the account holders of the FI Money neo bank get the facility of a VISA debit card that is allocated along with the account they open. FIT rules are one of the artificial intelligence features of FI Money. It is done by putting checks that depend upon the shows, like cricket matches and other famous events. So, ideally, if a statement by a particular person shows up where his targeted team wins, then that individual is eligible to get his pre-decided money in his custom savings account.

Website Link: https://fi.money/

Founder: Sujith Narayanan and Sumit Gwalani

Founding Year: 2019

Address: Sattva Knowledge Court, 7th Cross Rd, Green Domain Layout, EPIP Zone, Whitefield, Bengaluru, Karnataka 560048.

Also Check ➜: 31 Best HRMS software in India

6. Finin

It is India’s first consumer-facing and customer-centric innovative banking neobank powered by SBM bank. The bank follows the contemporary neo banking startup approach. Its features are customers’ financial portfolio success, hyper-personalized incentives or rewards, impressive interest rates, and decent account & card management. With the help of this neobank, you can smoothly open your account as well as manage it through their comprehensive application. It is equipe with Artificial Intelligence technology. On December 14, 2021, this neobank in India was acquired by Open with the mindset of adding value to it along with other SMEs.

Moreover, this neo bank supports its customer base by guiding them on multiple alternatives to improve their financial status. Finding neo bank has been backed up by numerous top-class investors like Unicorn India Ventures. According to the owner of Finin neo bank, value has create in the lives of its consumers. It’s best for SMEs wishing to open employee salary accounts, consumer banking rails, and banks wanting to launch digital banking proposals with the help of digital banking.

Website Link: https://finin.in/

Founder: Suman Gandham

Founding Year: 2019,

Address: Sai Raghavendra’s Bloomsfields #43, 7th Cross, Ramagondanahalli, Bangalore, India, Karnataka

7. Freo

It is India’s first ever credit-led neo banking app powered by MoneyTap. Freo is the child neo-bank business of MoneyTap, whose motive is to help its users to get an exceptional banking experience. The digital bank products are MoneyTap, freo pay, freo save, and freo cards. Freo utilities are Fit. Credit and Super Split. Its superior services allow you to avail of the credit with adequate capital supervision. Its varied features are a 7% interest rate, lifetime credit line of up to INR 5,00,000, smooth daily essential purchases with credit up to Rs. 3,000, EMI facilities, Freo’s suite, expenses splitting with friends, etc.

Like a physical bank, Freo is set and ready to provide numerous product portfolio ranges to its customer base. It includes Buy Now Pay Later, loans, bank accounts, credit, etc. However, the previous 2 to 3 years have noticed the emergence of numerous neo banks all set on the same criteria, i.e., goal-based investment and savings. Freo acts on different parameters. It will be working on the Credit-led Neo Bank model and is the first in India to work this way.

Website Link: https://freo.money/

Founder: Anuj Kacker

Founding Year: 2019

Address: Sigma Soft Tech Park, Gamma Block, Post, Varthur Kodi, Palm Meadows, Whitefield, Bengaluru, Karnataka 560066

8. InstantPay

InstantPay is the most enormous API Neo Banking platform providing full-stack digital banking aids for individuals and corporations, irrespective of employee size. The slogan of the InstantPay neo bank is – ‘Banking for the New India.’ Also, it offers personal banking, business banking, and inclusive banking services. Personal banking includes all ATM cash withdrawals, no minimum balance, transaction limit set up, in-store/online payments, bank deposit money investment, digital gold purchase, and pay later options. Business banking has built-in CRM, expense management, business loan/overdraft offers, personalized account numbers/debit cards/checkbook, value-added services, and multiway payment collection.

Finally, inclusive banking allows you to discover InstantPay Digi Kendra & has features like citizen services, travel bookings, insurance services, Nepal/domestic money transfer, and value-added services. Its features also include tracking of money on a real-time basis, Immediate account activation, smooth depositing of cash, and 24*7 customer support service.

All the banking alternatives provided by this neobank in India are straightforward and allow a smooth path to save, spend, and manage users’ savings in the online mode. More than 1 million transactions occur daily, 10 million monthly & $1 billion quarterly on their platform. The well-known partners of this neo bank are Axis Bank, Yes Bank, ICICI Bank, and IndusInd Bank.

Website Link: https://www.instantpay.in/

Founder: Shailendra Agarwal, Sankalp Shangari, Amol Sonbarse, Ajay Upadhyay

Founding Year: 2013

Address: B1/A5, Block E, Mohan Cooperative Industrial Estate, Badarpur, New Delhi.

9. Jupiter

Jupiter is the fastest 100% digital payment RBI-licensed neobank in India that’s UPI-based, ISO, and PCI compliant. It has varied features like no hidden fees, zero balance account, portfolio analyzer to track mutual funds, wealth growth on Networth, VISA debit cards, pots autopilot savings, pre-salary account, and insured money up to INR 5,00,000. The best feature of this application that makes it loved is its’ Spending Habits Tracking’ feature called ‘Insights.’ In addition, you get 1% instant real-time rewards on buying UPI & debit cards. The target audience and demographics of the Jupiter neo bank are similar to the Fi Money neo bank. So, ideally, this makes each of these two neo-banks competitors.

Automated savings are a crucial part of Jupiter. The entire concept of it is summoned up as ‘Pots’ & it gives an interest rate of around 2.5%. Furthermore, the Jupiter neo bank provides the invite-only campaign known as ‘Mission Invite.’ It allows the new users to operate the application in two ways. The first alternative is to get invited through an existing member’s invitation and the second alternative is through an exclusive invite made by the concerned team of Jupiter. Please note that Jupiter and FI have a partnership with a Federal Bank. Henceforth, an individual can open his account in one bank at a time. Although, in between the process, you can switch to the other neo bank.

Website Link: https://jupiter.money/

Founder: Jitendra Gupta

Founding Year: 2019

Address: 32, 3rd Floor, Viraj Building, Plot No. 124, S V Road, Khar West, Mumbai, Maharashtra

Also Check ➜: What is KRA and KPI?

10. Mahila Money

Mahila Money is a full-stack financial platform Neobank in India providing tremendous help to female entrepreneurs in urban & and suburban areas. The tagline of the neo bank is “#JiyoApneDumPe.” It’s one of the most robust platforms that help all those left-out women entrepreneurs without micro-financial support. The vast features of this neo bank are access to wellness programs, business tips, prepaid cards, collateral-free business loans, live events with experts, community interaction, and exclusive referral rewards. It’s conduct partnership with Capital Trade Links Ltd NBFC.

The interest is also applicable on the loans you take & it’s around 20% p.a. Many people consider this loan amount relatively high as other banks offer the loan at lesser amounts, although these loans are not secure. Nobody can resist the community-based features of this neo-bank. Such features help their customers communicate, share, and get good insights on different financial aid-related topics. This way, newcomers who have just entered the business world get good knowledge.

Website Link: https://www.mahila.money/

Founder: Sairee Chahal, Siddhika Agarwal, and Vaibhav Kathju

Founding Year: 2021

Address: 4054, pocket 5 and 6, sector-b, Vasant Kunj, Vasant vihar, southwest Delhi.

11. Mool

One of the most popular Neobanks in India, Mool concentrates upon investments, wealth management, innovative banking & savings. Also, it is labeled as ‘Be good with money.’ Mool has varied features like no minimum balance, no account fees, smart savings account opening in 5 minutes, transactions from nearby ATMs, and automated investments from savings. Other features include smooth setup & wealth tracking, virtual cards, instant payments, personalized insights, timeline view, an intelligent planning system, bank-grade security, payment app linking, and credit score building. Mool neo bank has multiple partners, including IRDA licensed Insurers, RBI approved Bank & SEBI authorized AMCs.

The Mool neo bank’s primary focus is correcting the distribution and design-related challenges. Therefore, it allows its users to best use all the present economic opportunities. Moreover, you can easily use the personalized & curated innovative plans and keep the auto-pilot on savings and investment. The Mool app also delivers contactless cards, stimulates instant payments & supports constructing the credit score every time the transaction from the user takes place. You can go to the App Store or Playstore to download this application.

Website Link: https://www.mool.one/

Founder: Abhinav Nayar

Founding Year: 2020

Address: B-7 Allied House Shopping Complex, Vasant Kunj, New Delhi

12. Niyo

Niyo neobank in India is an ideal bank for international travelers. It offers lounge access, zero forex markup, and up to 5% interest on savings accounts. With an amount up to 2 lakh, you earn 3.5% interest; between 2 lakh to 5 lakh, you earn 4% interest; and above 5 lakh, you make 5% interest in partnership with SBM & DCB bank. You can earn up to 7% interest in collaboration with equitas. It offers various benefits like Zero Forex Markup, 24*7 app chat support, monthly payouts, and inr to 150+ currencies conversion & spending at 0 charges. Niyo brings up various valuable banking products:

1. Niyo Global – Niyo Global provides round-the-clock support to its customers. Simultaneously, they get benefits with a 5% interest in their overall savings.

2. Niyo X – Customers find saving & managing their overall wealth extremely simple using the Niyo X.

3. Niyo Bharat – Niyo Bharat application guarantees providing the salary cards to the respective employees. It’s been known to people as an open banking platform.

4. Niyo Money – Niyo Money aims to support its customer base in growing & managing wealth. It’s been empowered by Robo-advisory.

Website Link: https://www.goniyo.com/

Founder: Vinay Bagri, Virender Bisht

Founding Year: 2015

Address: Incubex Nestavera Indiranagar # 728, Grace Platina,4th Floor, Chinmaya Mission Hospital Rd, Indira Nagar 1st Stage, Bengaluru, Karnataka 560038

13. OneCard

OneCard is a versatile platform & newcomer in the neo bank list. They also, provide exclusive offers on their card purchases & transactions. You get a big discount on online shopping sites like Bewakoof.com etc. & on food & dining like ‘The good bowl,’ ‘Firangi Bake,’ ‘Oven story,’ etc. And also, you can also avail of significant discounts on electronic sites like boAt & on health & wellness platforms like Sugar cosmetics & lifestyle segments like IGP. The card is best to be availed by those people who are new to the ‘credit card’ concept & are looking forward to earning rewards on every purchase. Also, oneCard has been featured in Your Story, Business Standard, Inc 42, Business Line, etc.

With no hidden fees, zero rewards redemption fees, or zero joining annual fees, the company has gained the confidence of many people. The exclusive metal credit card app helps you with contactless payments for domestic and international transactions. OneCard has strong investors who back them with similar visions, missions, and goals. Sequoia, Matrix Partners India, and Hummingbird are some of their investors. As part of this, the OneCard app offers the 47 days prior, interest-free feature. It means you are given these many days to complete your new payment amount in case there are no prior dues.

Website Link: https://getonecard.app/

Founder: Rupesh Kumar, Anurag Sinha

Founding Year: 2019

Address: Disha Bldg, Survey No 127, Mahavir Park, Pune

14. Open

Open, India’s 100th Unicorn, is a technology-based platform & a Neobank in India powering 25,00,000 businesses. The overall motive of Open bank is to promote ease of digital business banking operations to the small business besides their existing accounts. It also offers VISA business cards that further support you in conducting all the functions related to accounting, banking, payments management, etc. The fantastic features of the Open neo bank are integrated expense management, immediate use as a virtual card, best debit card for business transactions, acceptance of VISA card, physical card in a week, and virtual & expense VISA cards.

You also get automated accounting, robust APIs, expense management, powerful banking experience, a smooth salary & vendor payouts. Another Neo bank named Finin neo banking startup was acquire Open neo bank at $10 million on December 14, 2021. Multiple investors participated in closing the $50 million financing integrated by IIFL finance. It comprises renowned investors like Tiger Global, Temasek, and 3one4 Capital. Open neo bank is said to have arrived into the section of a unicorn club after hitting the $1 million value.

Website Link: https://open.money/

Founder: Mabel Chacko, Anish Achuthan, Ajeesh Achuthan

Founding Year: 2017

Address: 3rd Floor, Tower 2, RGA Techpark, Sarjapur – Marathahalli Rd, Carmelaram, Bengaluru, Karnataka 560035

15. Paytm Bank

Paytm Bank is Also, the best in Neobanks in India and is an RBI-approved digital wallet where its customers meet most of their financial requirements. This payments bank provides you with all the features it does in its wallet. It includes a VISA debit card, risk-free deposit, no account fees, monthly interest benefits, international acceptance, contactless transactions, cashback, offers, rewards, ATM cash withdrawals, high-end secure transactions, and passbook updates on a real-time basis. You also get 2.5% interest every year in your savings account money. The plus attribute is that it doesn’t demand you to maintain a minimum balance in the Paytm bank account.

Ideally, you can perform all digital transactions like NEFT, UPI, and IMPS at zero cost. Moreover, every time you credit or debit the money in the Paytm neo bank, you are free from paying an extra fee for the transaction. Every transaction, fixed deposit, and the amount stored in your Wallets Card, FASTag, UPIs, and Paytm Wallet is 100% safe. Moreover, the neo bank allows you to pay your monthly utility bills like cylinder purchase, gas bill, electricity bill, etc. You can also recharge your number and get exciting offers on booking cabs and flights online through their platform.

Website Link: https://www.paytmbank.com/

Founder: Vijay Shekhar Sharma

Founding Year: 2010

Address: 136, 1st Floor, Devika Tower, Nehru Place, New Delhi 110019

16. Piggy Neobank

A powerful money app with a debit card inbuilt savings account, helping you save money while spending it. It has an all-in-one investment product, innovative banking options, and personalized recommendations. The former name of a PiggyVest is Piggy Bank. Piggy is an intelligent money app that strives to comfort its customers by bringing investments, banking, and financial advice to one platform. You can create pots, add a goal amount to them & add money to pots according to your preferences. Piggy pots help you categorize, organize, manage, and save money. Whenever you go for high-value purchases, you get some of the best deals to ease the burden of spending vast amounts of money.

Moreover, you also get valuable rewards that help you with your further purchases. It works on the ‘Save while Spend’ protocol. So, whenever you spend in the various portfolios like Swiggy order, Uber ride, etc., a part of it gets automatically saved in your piggy bank & for investment in multiple platforms. The app likewise permits you to invest your finances in the desired ventures. Through this investment, you get at least 25% in returns in a minimal period, like eight months or more than this, based on the venture.

Website Link: https://www.piggy.co.in/

Founder: Ankush Singh, Nikhil Mantha, Kunal Sangwan

Founding Year: 2016

Address: Piggy HQ, 3rd, The Atlantic CentreHAL 2nd Stage, Kodihalli, Bengaluru, Karnataka 560008

17. RazorpayX

The API-driven automation platform, Razorpay X Neobank in India helps its targeted niche of SMEs to accept payments from their customers smoothly and automate payouts for vendors & employees without running out of working capital. RazorPayX supports these SMEs through its mind-blowing smooth banking traits so they can efficiently conduct their business operations. The powerful gateway has varied features like simple integration, 100+ payment methods, exceptional checkout experience, fast settlements, dashboard reporting, PCI DSS Level 1 compliant solution, subscription plans, high success rate, and in-depth insights & reporting.

Through the platform of RazorPayX, you could also avail yourself of instant loans and corporate cards without collateral to their customer base. Moreover, all the current account users of RazorPay benefit from the features like business reporting, tax & vendor payment automation, etc. The Neo bank has brought outstanding innovations in the market, especially in the past five years. The bank covers vendors’ payouts, current account gamut, and payroll. So far, the total funds by the banks stand at $200 million. These marquee investors are Ribbit Capital, Sequoia Capital, Matrix Partners, Tiger Global, GIC, and well-known stellar angels.

Website Link: https://razorpay.com/x/current-accounts/

Founder: Shashank Kumar

Founding Year: 2014

Address: 1st Floor, SJR Cyber, 22 Laskar Hosur Road, Adugodi, Bangalore, Karnataka 560030

18. Uni Card

Uniorbit Technologies launched the UNI ½ Card & UNI ⅓ Card Neobank in India that VISA backs. They partnered with various banks for this launch, like the State Bank of Mauritius, RBL bank, and Liquiloans. The card operates differently than the traditional cards, where you can split your payments & are always in control of your transactions. It allows you to set your payment limit, lock & unlock your card, and decide on where & how to spend through their app. Their platform is secure, free for a lifetime, 24*7 available on WhatsApp with no joining fees, annual charges, or hidden charges. Also, your interest doesn’t start from your first billing. Using this credit card, you are allowed to complete your bill payments in three parts respectively. So, whenever you go to a party, shop for groceries, or pay other bills, you may pay the ⅓ amount.

Rest is completed within three months, and you won’t be charged any additional fee. You get 1% cashback after completing the bill payment through their platform, rewards when you pay the total amount & up to 5X value on their Uni Store. With the UNI ½ Card, the cost is split into two parts & you can earn 1.2% rewards by completing payment in 1 month. The Uni Card freezes on not using it consecutively for six months. The Uni customers are charge the total amount once the 30 days free credit period is over. The UNI Card’s credit limit is between INR 20,000 to 6 lakhs. Avail your Uni Card in 5 minutes or less with 100% paperless work & 0% hassle. It’s the best alternative for first-time users.

Website Link: https://www.uni.cards/

Founder: Nitin Gupta, Prateek Jindal

Founding Year: 2020

Address: No.3/B Nexus Koramangala, 3rd Block, SBI Colony, Koramangala, Bengaluru, Karnataka 560034

19. Walrus Club

Walrus Club neobank in India is the First Neon Signature Card in India powered by VISA & aims to plant the seed of financial savings among the Instagram generation. By joining the walrus club, you share stories with old friends and new & fun people. Also, walrus store provides special offers, discounts, & rewards on big brands like Flipkart, mantra, boat, Domino, etc. Registered users get a chance to win a PS5, iPhone, Sony Headphones, etc., by playing their Walrus Premier League. You could also earn & redeem the Walrus bitcoins at the latest market price while using the app. No bank account is requires to make transactions at your favorite store as it’s done directly from the walrus wallet.

Multiple users of the Walrus Club app download it from the Playstore. But, after the successful download and installation, digital KYC verification is required. All the teen or below teen children’s money can be loaded only by their parents through debit cards, net banking, and UPI payments. Walrus Club is built to support all the young Indians financially. These youngsters from India get their first-ever debit card from Walrus Club. This way, they can start saving, spending & investing in the early stages of their life. The neo bank has 500K registered members & it was live six months ago. The banking partners of the Walrus Club are Transcorp and Mastercard. It supplies its debit cards to customers for online transactions and purchases.

Website Link: https://walrus.club/

Founder: Bhagaban Behera, Sriharsha Setty, Nakul Kelkar

Founding Year: 2019

Address: 703, Honeycomb, 2nd sector, HSR Layout, Bengaluru, Karnataka 560008

20. ZikZuk

The neobank in India is inclined toward Indian SMEs & is established with the overall motive of enhancing the Indian SMEs’ growth. Features of ZikZuk neo bank are business finance manager, SME credit card, Data Aggregation & connected banking. It offers various products and services & among all its offerings, FoundersCard is the most popular one. FoundersCard is a credit card meant to help founders and entrepreneurs get top-class credit scores, and Artificial Intelligence generated business reports & several other rewards or benefits. Business Finance Manager is a machine learning or an artificial intelligence-based data-driven business intelligence platform.

It helps SMEs by motivating them to focus on their business growth while they synchronize to various accounting software like Tally & manage their business finance. Connected Banking is a tool helping you access & manage your multiple bank accounts in a single place. Using a single window, folks find it easy to track their savings & spending via their secured Connected Banking. This Neo bank is well known for its data integration features. You can find all of your bank accounts on this platform for smooth and fast processing. All the prominent founders of the various sector companies get the credit for overcoming their on-the-spot needs for capital.

Website Link: https://www.zikzuk.com/

Founder: Tarun Bansal

Founding Year: 2020

Address: 3rd, CSR Estate, 8 Sector 1, Hitech City Main Rd, HUDA Techno Enclave, Madhapur, Hyderabad.

21. Zolve

Zolve neobank in India is a cross-border fintech facilitating smooth accessibility to all global financial products. This Neo banking startup has a network of 37,000 ATMs & is made with the overall motive of helping US immigrants avail of top-notch financial services. It has varied features like card freezing & unfreezing in a click, no SSN or US credit history, no upfront or membership fees, high limit credit card up to $10,000 credit limit, reward programs, up to 10% cashback, 5 min online application and pre-approval for everybody. Moreover, it enables credit building as soon as your first transaction happens, along with seamless payment alerts and experience. Furthermore, it has up to 2% interest with your boost account & allows minimal cost and lightning-fast international transfers.

This Neobank in India raised $40 million last year in October. Many investors participated and were interested in the fundraising process, including Lightspeed Venture Partners, Tiger Global, Accel, and Alkeon Capital. According to one of the TechCrunch interviews, the well-known entrepreneur Raghunandan G revealed that Zolve distributed its credit card to its 2000 users. The users can avail themselves of tailored financial services like a debit card & a local bank account from the credit card. The company made $2 million last year in October 2021. Zolve works closely with Indians and US to make online financial services easy for them through 0 premium payment or security deposits. The Zolve team started with a count of 5 people and now extended its team to 100. The count is soon plan to reach 150 people.

Website Link: https://zolve.com/

Founder: Raghunandan G

Founding Year: 2020

Address: 7th Floor, EcoWorld 6B, Outer Ring Road, Devarabeensanahalli Village, Bengaluru.

Conclusion

Neobanking has brought fresh air to the way traditional banking works in India. It’s giving birth to new innovative ideas to save, manage and intensify money in the upcoming time. Various businesses and individual folks benefit from such tremendous banking activities. There lie multiple reasons behind its overall success rate in India. One of the primary reasons is the personalized & customized financial services the neo banks provide. Another reason is the handy, convenient, and latest technology adoption. Neobanks in India have proved to be a big-time game changer, whereas traditional banks are trying their best to compete in this race.

With its excellent savings, tailored financial solutions, no-cost banking services, operational ease, and latest technological advancements, This list of Neobanks in India has gained immense popularity. Neo banks will undoubtedly take over all traditional ways of handling finances. This phenomenon has grown massively in India in the last few years. Also, while counting the list of industry leaders, neo banks would occupy the number 1 rank in the upcoming few years.

Join a Community of 1,00,000+ HR Professionals